The Leading Myths and Misconceptions Concerning Offshore Investment Debunked

The Leading Myths and Misconceptions Concerning Offshore Investment Debunked

Blog Article

Understanding the Kinds Of Offshore Financial Investment and Their Unique Attributes

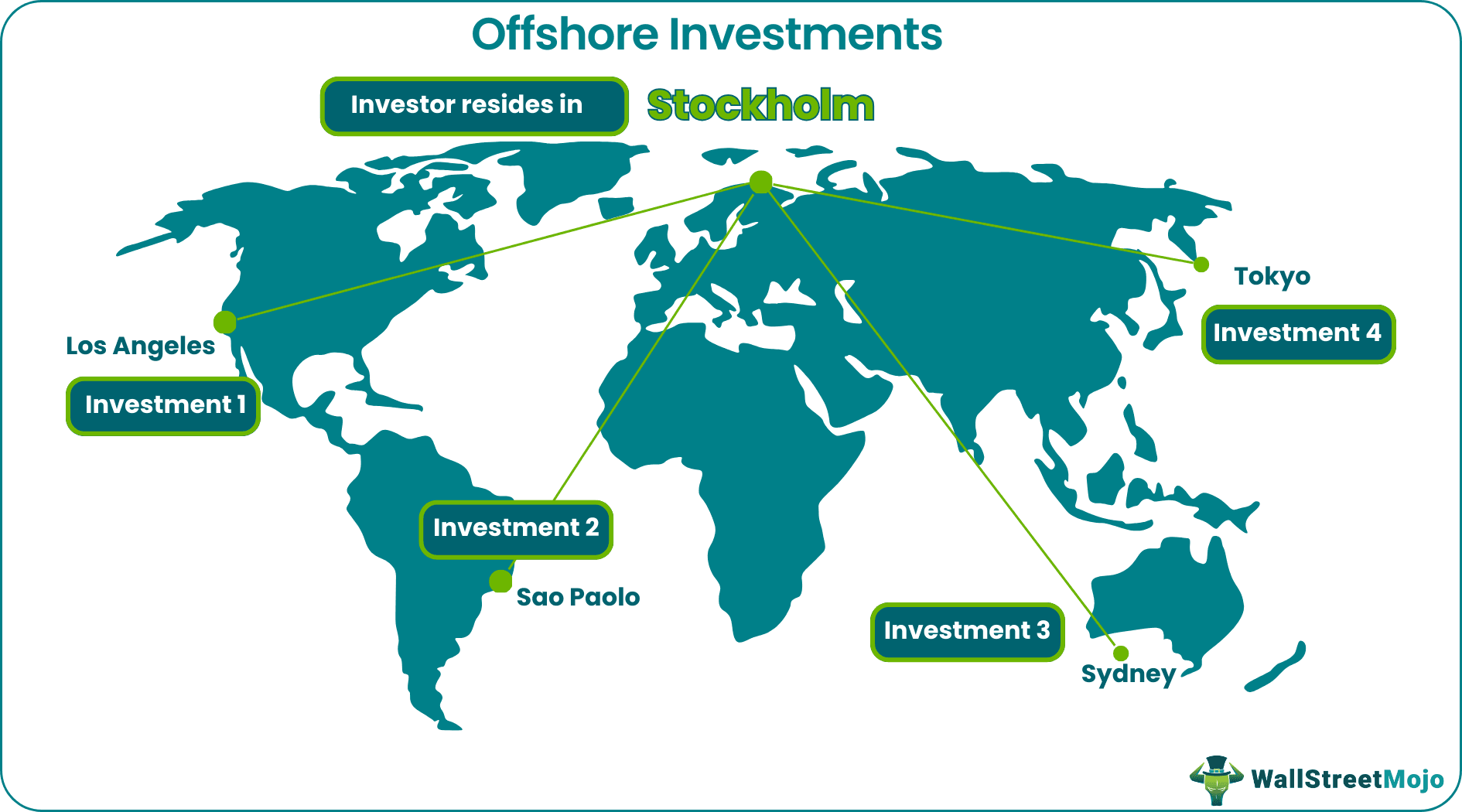

In a progressively globalized economic climate, comprehending the different types of overseas financial investments is important for reliable wide range management and possession protection. Each financial investment vehicle, from overseas financial institution accounts to shared funds and trust funds, provides distinct features customized to satisfy diverse economic objectives.

Offshore Financial Institution Accounts

Offshore bank accounts serve as a critical financial device for organizations and individuals seeking to diversify their properties and handle money threat. These accounts are normally established in territories that offer desirable financial policies, personal privacy protections, and a steady political and financial atmosphere. By holding funds in diverse money, account holders can properly alleviate the dangers related to money changes, guaranteeing greater monetary security.

Nonetheless, it is important to abide by all appropriate tax obligation legislations and guidelines when utilizing overseas financial solutions. Failing to do so might lead to lawful effects and punitive damages. Potential account holders should seek professional advice to browse the intricacies of offshore financial and ensure they are totally certified while gaining the advantages of asset diversity and risk monitoring.

Offshore Mutual Finances

Purchasing common funds can be an effective technique for individuals looking for to access global markets while profiting from professional monitoring and diversification. Offshore common funds serve as a compelling alternative for investors wanting to take advantage of chances beyond their residential markets. These funds pool resources from several investors to purchase a varied profile of possessions, which might include equities, bonds, and alternate financial investments.

Among the primary advantages of offshore shared funds is the possibility for boosted returns through access to global markets that might not be readily available domestically. These funds typically provide tax obligation advantages depending on the jurisdiction, enabling financiers to enhance their tax responsibilities. Additionally, professional fund managers proactively take care of these financial investments, making notified choices based upon extensive research and market analysis.

Investors in offshore common funds profit from the adaptability to choose different fund methods, varying from traditional to aggressive investment techniques. This range enables people to straighten their investment choices with their risk resistance and economic objectives. Nevertheless, it is essential for financiers to conduct complete due diligence and understand the regulative atmosphere, charges, and risks related to these financial investment automobiles before dedicating capital.

Offshore Trust Funds

Counts on represent a critical monetary tool for individuals seeking to take care of and safeguard their possessions while potentially taking advantage of tax efficiencies. Offshore Investment. Offshore trusts are established outside the person's home country, permitting for boosted property defense, estate preparation, and privacy benefits. They can protect possessions from financial institutions, legal cases, and divorce negotiations, making them an attractive alternative for affluent individuals or those in high-risk occupations

In addition, overseas trust funds can provide substantial tax obligation benefits. Depending on the territory, they may supply beneficial tax therapy on income, resources gains, and inheritance. It is essential to navigate the legal complexities and compliance my sources requirements linked with overseas trusts, as falling short to do so can result in severe charges. Looking for expert suggestions is vital for anybody considering this investment approach.

Offshore Real Estate

A growing variety of capitalists are transforming to realty in international markets as a method of diversifying their portfolios and maximizing international chances - Offshore Investment. Offshore property financial investments provide several advantages, consisting of prospective tax advantages, possession defense, and the possibility to get properties in emerging markets with high growth capacity

Buying overseas property permits individuals to profit from favorable residential or commercial property legislations and policies in particular territories. Several nations supply incentives for international financiers, such as lowered taxes on resources gains or income created from rental homes. In addition, owning property in a foreign country can offer as a bush versus money fluctuations, supplying security in unpredictable financial climates.

In addition, offshore property can develop pathways for residency or citizenship in certain territories, improving individual and monetary wheelchair. Investors often look for properties in prime areas such as urban centers, playground, or areas going through significant growth, which can yield appealing rental returns and lasting gratitude.

Nonetheless, possible investors should perform comprehensive due persistance, understanding local market conditions, lawful frameworks, and property management ramifications to maximize their offshore property investments efficiently.

Offshore Insurance Coverage Products

Discovering offshore insurance items has actually ended up being a progressively preferred approach for individuals and companies seeking enhanced financial safety and security and property protection. These items supply distinct advantages, consisting of tax obligation benefits, privacy, and versatile financial investment options customized to business or personal needs.

An additional remarkable classification includes health and travel insurance coverage, which might supply extensive insurance coverage and defenses not available in the insurance policy holder's home nation. These items can be especially advantageous for expatriates click over here now or regular tourists that deal with unique threats.

Ultimately, overseas insurance policy items present a compelling alternative for those looking to boost their economic techniques. By offering customized remedies that highlight personal privacy and tax obligation performance, they can play a vital function in a diversified investment portfolio.

Verdict

In verdict, offshore financial investments existing diverse opportunities for riches management and asset security. Understanding the one-of-a-kind features of each overseas financial investment is vital for people and entities seeking to browse the complexities of international financing effectively.

In a significantly globalized economic situation, understanding the various kinds of offshore financial investments is critical for effective wealth monitoring and possession security. Each investment vehicle, from offshore financial institution accounts to mutual funds and trusts, provides unique features customized to useful reference meet diverse economic goals.Furthermore, overseas financial institution accounts can provide access to a range of monetary services, including investment possibilities, offering facilities, and wealth monitoring options.Capitalists in overseas shared funds profit from the adaptability to choose different fund methods, varying from traditional to hostile financial investment methods. Comprehending the one-of-a-kind attributes of each offshore financial investment is crucial for entities and individuals seeking to navigate the complexities of global financing efficiently.

Report this page